In the past, digital marketing campaigns and sales strategies adopted a shotgun-like approach – spraying tactics all over the place to see what hit. And while plenty of successful companies used this method to build the foundation for highly successful campaigns, it was an extremely “hit or miss” approach. It was also difficult (if not impossible) to accurately measure.

Fast forward to the internet age and most modern companies – regardless of size, industry or niche – have access to tools and systems that allow them to implement highly-targeted campaigns that zero in on very specific customers. Not only that, but they can measure their results to understand precisely what’s happening on the ground floor.

One of the favorite measurements is something called Customer Acquisition Cost, or CAC. And if you want to gain more clarity into the efficacy of your own marketing, advertising, and growth strategies, we’d highly recommend learning more about your own Customer Acquisition Cost(CAC), so that you can optimize it for greater profitability.

Table of Contents

What is Customer Acquisition Cost?

Customer acquisition cost is basically a measurement that analyzes the total costs of taking the lead, turning them into a prospect, and ultimately transforming that prospect into a customer. In other words, it’s the total costs of taking someone who has no relationship with your brand and getting them to spend money. It compares the total amount of money spent on attracting customers over a period compared to the number of customers onboarded.

Businesses and investors alike want to see customer acquisition costs be as low as possible. The lower the cost, the higher the profitability – it’s as simple as that.

So how do you calculate Customer Acquisition Cost or CAC?

The basic equation looks like this:

CAC = (total cost of sales + total cost of marketing) / (# of customers acquired)

Here’s an illustration:

Customer Acquisition Cost,(CAC) = ($10,000 spent) / (100 customers acquired) = $100 per customer

The formula is simple enough to understand. There are only two variables, and the second one (# of acquiring customers) is dead simple to calculate. But in order to get an accurate output, you have to be sure you’re including everything in the total costs of sales and marketing.

Every business model is different, but here are some expenses that typically go into this equation:

- Ad spend. This is a pretty easy metric to calculate. It’s the total ad spend of all campaigns. This may include Facebook, Google Ads, display ads, or even billboards.

- Wages. How much are you paying your team? This includes both employees and freelancers/contractors. This will probably be your single largest expense. (Unless you’re running a very small business, in which case ad spend could be your biggest line item.)

- Software/tech. What sort of technology do you have running in the background? This may include email marketing software, CRM, social media automation tools, or VoIP service. It’s easy to forget about these, but they’re an expense and must be accounted for.

- Production. Consider the cost of producing marketing and advertising assets. What’s the cost of creating content and publishing it so that people engage with it?

Depending on the sales and digital marketing strategies you use, there may be other expenses to add; however, this is a pretty decent place to start.

The biggest key with Customer Acquisition Cost, or CAC is to determine what time period you’ll use. It’s helpful to track your CAC over time, so that you can study trends. Most businesses choose monthly, quarterly, or annual periods. If you’re just starting out, we’d recommend monthly or quarterly.

Example: Acme Coffee Mug Company

You may find it helpful to look at an example to better understand Customer Acquisition Cost, or CAC and why it matters. So let’s use a fictional company, which we’ll call the Acme Coffee Mug Company.

The Acme coffee mug company sells trendy coffee mugs through an ecommerce store. They’ve built a nice little niche for themselves and have seen their volume of sales really take off over the past 18 months.

Over the previous month, the company spent $3,000 on sales and marketing, while generating 1,000 new sales. This means their CAC is $3.

For some companies, a $3 CAC would be amazing. (If it only took Apple $3 to get someone to purchase a $2,000 computer, they’d be elated.) But for the Acme Coffee Mug Company, we need to dig a little deeper to understand what this means for their bottom line.

On average, mugs sell for $10. But that’s at a 100 percent markup. In other words, they’re only making $5 after they account for purchasing the inventory and printing the designs. Then if you take away the $3 CAC, they’re really only bringing in $2 net per mug.

Sure, they’re profitable, but they’re going through a lot of effort to generate $2 in revenue. Before calculating Customer Acquisition Cost, or CAC, they probably thought they were doing better than they actually are. But now that they understand the total cost, they can begin looking for opportunities to improve the bottom line.

The first thing the Acme Coffee Mug Company should do is look for ways to increase the average transaction size for customers. See, the CAC remains the same regardless of whether the customer purchases one mug or a dozen mugs. So if they can get people to spend more (either up front or over time), it automatically increases their profitability.

A $3 CAC isn’t great if you’re only making $5 per mug. But it’s pretty darn incredible if you’re generating $60 per customer. This speaks to the importance of (a) calculate customer acquisition cost while (b) increasing customer lifetime value (CLV). Find a way to pull both levers at the same time and amazing things will happen.

Technically speaking, calculate Customer Acquisition Cost or CAC does nothing for you. It’s simply a measurement. The biggest thing is what you do with it. And once you understand CAC, the mission becomes clear: Get it lower.

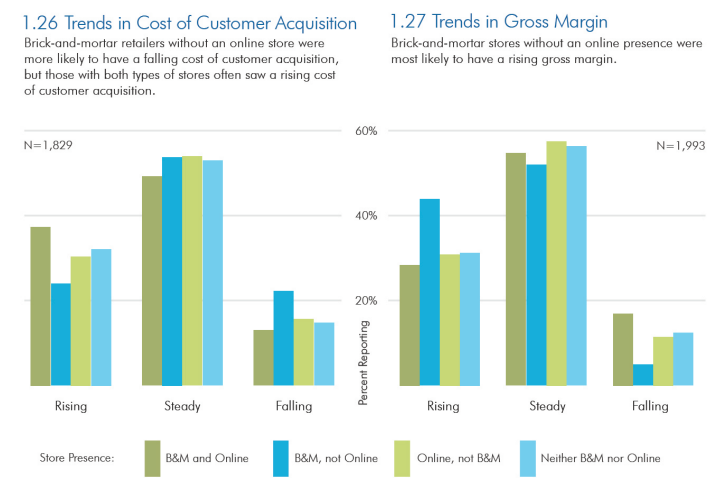

Average Customer Acquisition Cost By Industry & Distribution Medium

Sometimes it’s helpful to understand what other businesses within your space are doing. And while we don’t recommend accepting these figures as gospel truth, here are some very basic CAC averages by industry:

- Travel: $7

- Retail: $10

- Consumer Goods: $22

- Manufacturing: $83

- Transportation: $98

- Marketing Agency: $141

- Financial: $175

- Technology (Hardware): $182

- Real Estate: $213

- Banking/Insurance: $303

- Telecom: $315

- Technology (Software): $395

This gives you an idea of how variable Customer Acquisition Cost or CAC can be from one business to the next. Perspective is everything – don’t lose sight of what industry you’re in and what the CLV is.

5 Ways to Improve Customer Acquisition Cost

Whether you already have a fairly healthy Customer Acquisition Cost, or CAC, or you’re losing money, it’s always wise to consider ways to improve this metric. Here are a few specific ways you can lower your customer acquisition cost and increase profitability:

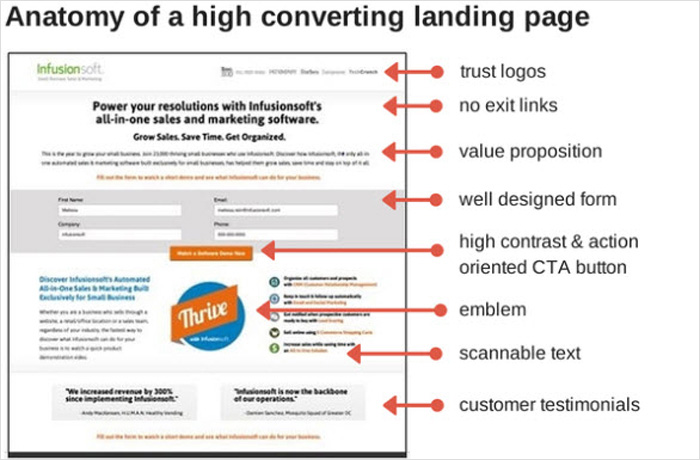

1. Optimize Sales Page Conversion Rate

When you think about it, 99.9 percent of your customer acquisition costs is spent getting a customer to your product/service landing page. At this point, you’re on the one-yard line – you just have to push the nose of the football into the end zone. If you have a high bounce rate on your sales page, it’s absolutely tanking your Customer Acquisition Cost, or CAC. The smartest thing you can do is increase sales page conversion rate.

Optimizing a sales page conversion rate is all about measuring the number, observing behavior, and making smart tweaks that reduce friction while increasing perceived value. Here are a few suggestions:

- Use exit-intent pop-ups to discourage people from leaving the page. Try offering a freebie, discount code, or highly-attractive benefit that hasn’t already been mentioned.

- Integrate more social proof into your sales pages. This includes reviews, testimonials, logos, and statistics.

- A/B test your CTAs to ensure you’re using the right copy and design to motivate people to take action.

- Use a countdown timer to create scarcity and promote FOMO in the customer’s mind.

- Remove all unnecessary fields. Only require the bare minimum information for a visitor to convert. (You can always ask for more information after the point of purchase.)

You’ll never regret any investment you make in optimizing your sales page conversion rate. Done well, you can dramatically lower costs by increasing the number of prospects who become customers.

2. Better Ad Targeting

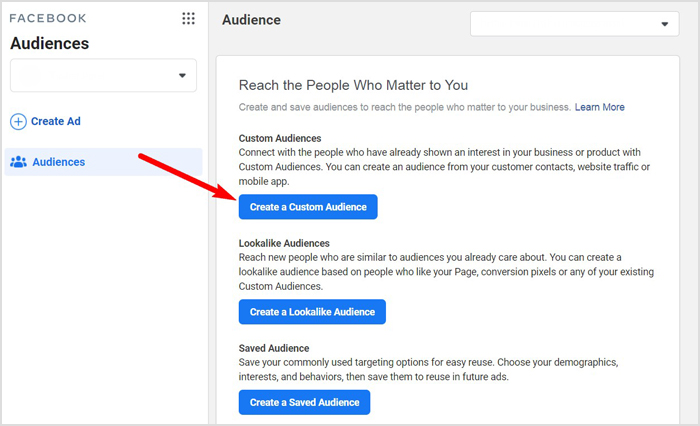

If you’re acquiring a lot of your customers via advertising, you’ll find better ad targeting to be a simple way to lower costs and improve CAC. And in terms of laser-focused targeting, no platform comes close to matching the power of Facebook.

If you’re working with limited data, but want to experiment with better targeting right away, you can try using the Audience Insights feature to refine your approach. Here’s how this method works:

- Pull up the Audience Insights dashboard and select “Everyone on Facebook.”

- Go to the “Create Audience” tab and use very basic targeting options like age, gender, location, and interests. The goal is to build an audience that matches your target audience persona.

- Click on the “Page Likes” tab to discover the pages your target audience connects with. Copy and paste these pages into a document or spreadsheet.

- Return to the “Create Audience” page and type the name of your biggest competitor into the “Interests” field.

- Review the demographics information that shows up on the screen to see if you can learn any new information about their audience (which could help you refine your own).

- Now create a new audience based on the information you glean.

- Test this audience against your existing one and see what happens.

- Repeat this process for as many competitors as you have (or until you find an audience that works).

This is just one strategy. There are countless techniques you can use to narrow targeting and find the right audience (which will dramatically lower your advertising costs and bring CAC down).

3. Outsource As Much As Possible

For many companies, salaries, wages, and employment-related expenses are the beefiest line items on the expense sheet. The leaner you can get in this area, the lower your Customer Acquisition Cost, or CAC will be. One solution is to outsource.

Outsourcing offers a number of benefits, but cost savings are the most noteworthy. When you outsource SEO tasks like content creation, graphic design, link building services, PPC ad management, and even conversion rate optimization, you’re able to maintain a leaner team. This brings costs down and, assuming there’s no drop off in acquire customers, dramatically lowers your Customer Acquisition Cost, or CAC.

4. Implement a Referral Program

Once you have a loyal base of customers, you can try creating a referral program that rewards existing customers for onboarding new customers. You can provide discounts, coupons, free products, or any combination of perks. This is an inexpensive and effortless way to add new customers.

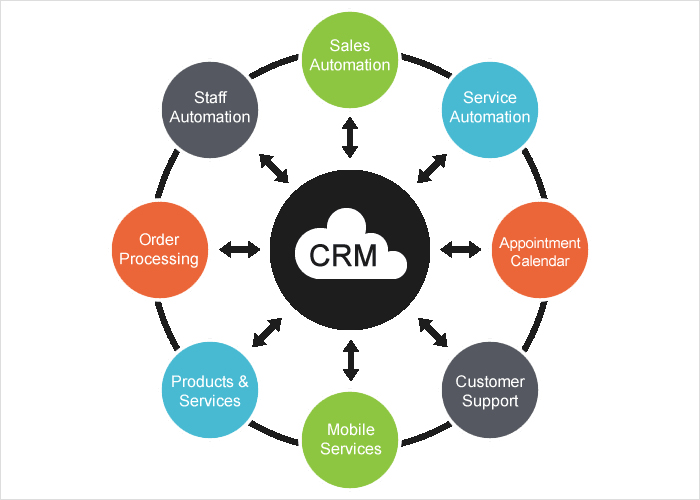

5. Use CRM to Streamline Sales

Don’t underestimate the value of using customer relationship management (CRM) software. Every successful company is using a CRM – don’t try to be the exception. These simple solutions make easy work of tracking customers, automating follow-up, calculating costs, and capturing loyalty. If nothing else, it’ll improve the accuracy of your CAC numbers.

The CLV:CAC Ratio

As mentioned above, the CAC is only one metric. It’s also helpful to measure CLV and other marketing ratios to determine your level of success. And when you compare the two, you get something known as the CLV: Customer Acquisition Cost, or CAC Ratio.

To understand this ratio, which is basically (CLV) / CAC, let’s use Netflix as an example.

Netflix reportedly has a customer lifetime value of $226.40 per customer and an acquisition cost of $11.32. If you take $226.40 (CLV) and divide it by $11.32 (CAC), you get a ratio of 20:1. In other words, they’re getting a 20X return per customer.

At first, a 20X return may seem impossible for your business – particularly if you aren’t in a subscription-based model – but that’s a shortsighted way of looking at things. There are companies out there who make 200X returns. It’s all about how you optimize your CAC and respect the importance of CLV.

Scale Your Traffic With SEO.co

At SEO.co, it’s our mission to help you execute your mission. We do this by providing industry-leading link building and content marketing services that empower businesses to scale organic traffic with high-quality digital collateral.

Want to join thousands of other successful clients and discover the power of organic, white-label link building? Contact us today to learn more!

Tim holds expertise in building and scaling sales operations, helping companies increase revenue efficiency and drive growth from websites and sales teams.

When he's not working, Tim enjoys playing a few rounds of disc golf, running, and spending time with his wife and family on the beach...preferably in Hawaii.

Over the years he's written for publications like Forbes, Entrepreneur, Marketing Land, Search Engine Journal, ReadWrite and other highly respected online publications. Connect with Tim on Linkedin & Twitter.

- Content Marketing: Using Content & SEO to Grow Your Business [Complete Guide] - October 23, 2024

- SEO for Labor and Employment Lawyers: Top Tactics to Rank - October 4, 2024

- How to Find & Fix Duplicate Content on Your Website - September 24, 2024